capital gains tax changes 2021 uk

A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some. 10 on assets 18 on property.

Income Tax Law Changes What Advisors Need To Know

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

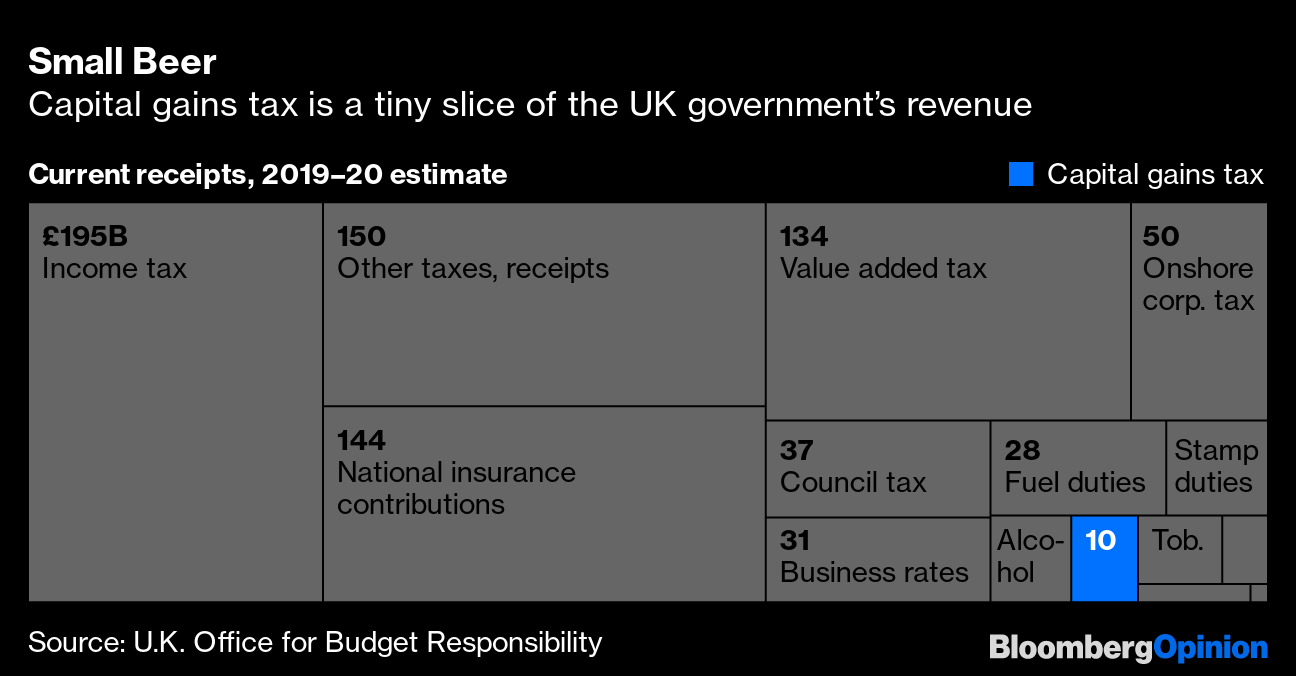

. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. Each year at the moment there is a personal capital gains tax allowance. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the Chancellor would bring CGT more in line with.

A range of new changes were introduced in the 2020 tax year for landlords including interest tax relief capital gains tax allowance and changes to how. The rise in total gains has gone hand-in-hand with the growth of super. All rates are markedly less.

One suggestion was aligning the Capital Gains tax rate with income tax. Almost all these gains went to a tiny minority. The Independent reports that the Chancellor is considering an increase to the headline rate of capital gains tax CGT bu.

So for the first 12300 of capital gain you could take that money completely tax-free. Changes Jul 21 2021. Capital Gains Tax UK changes are coming.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for most trustees also remains unchanged at 6150. Attend your first virtual pin meeting for FREE using the code YouTube just click on the link belowhttpspropertyinvestorsnetworkcoukmeetingsIn this.

They will pay tax on any profit above their tax-free allowance when. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25. Customers will continue to complete their tax return as now for any other Capital Gains Tax declarations in the future.

Business acquisitions accelerate in response to President Bidens plan to double the long-term capital gains tax rate for those at the top from 20 to 40. 92 of taxable gains went to people with more than 100000 in gains. When you include the 38 net.

Currently there are four rates of CGT between 10 and 28. This means youll pay 30 in Capital Gains Tax. Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40 per cent for the higher bracket and 45 per cent for the.

20 on assets and property. Any gain over that amount is taxed at what appears to be. The governments plans were outlined in its response to the Office of Tax.

At least five changes are coming to the capital gains tax system a letter from the Treasury has revealed. It is thought that income tax rates will be raised to 45. New buy to let changes for 20212022.

If you own a property with a. Currently basic-rate taxpayers pay 10 CGT on assets and 18 CGT on property while higher-rate taxpayers are charged 20 on assets and 28 on property. Which UK residents do not pay UK tax on.

The OTS recommended the new personal allowance be reduced from 12300 to between 2000. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. This was followed by Tax Day on 23 March through which more than 30 tax policies and consultations were published with the aim to modernise UK tax administration and policy.

This means the value of assets one can cash in without paying tax could be much smaller.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Will Capital Gains Tax Increase At Budget 2021 What The Property Tax Rate Is And How It Could Change Today

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

2021 Capital Gains Tax Rates In Europe Tax Foundation

Hmrc Tax Rates And Allowances For 2021 22 Simmons Simmons

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax Challenges In 2021 Effect On Property Investors Property Investors With Samuel Leeds

Biden Capital Gains Tax Rate Would Be Highest In Oecd

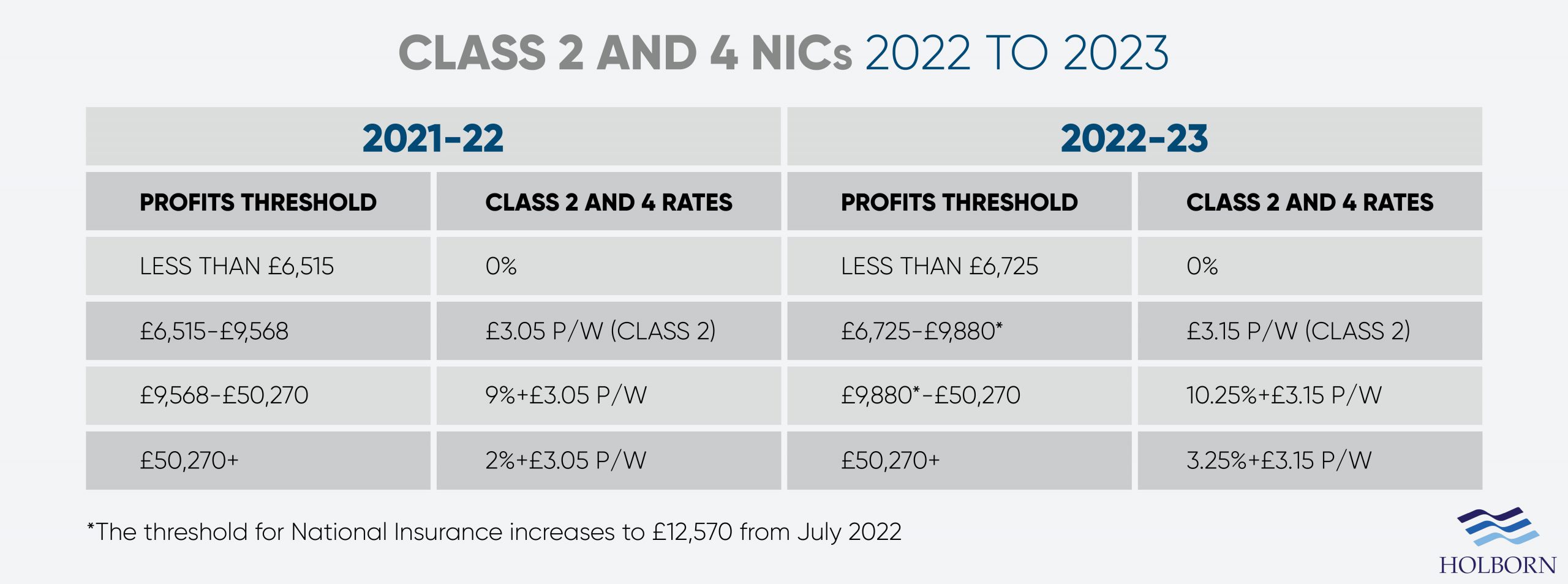

Changes To Uk Tax In 2022 Holborn Assets

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

How A Carbon Capital Gains Tax Can Curb Emissions

Understanding The Tax Implications Of Stock Trading Ally

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

The Overwhelming Case Against Capital Gains Taxation International Liberty